- GCaM

- Posts

- Tyrants of the Caribbean

Tyrants of the Caribbean

Dear all,

We welcome you to the Greater Caribbean Monitor (GCaM).

In this issue, you will find:

Libertarians take over Argentina, once again

Trump in search of the oil faucet in the Caribbean

What We’re Watching

As always, please feel free to share GCaM with your friends and colleagues.

If you’ve been forwarded this newsletter, you may click here to subscribe.

Best,

The GCaM Team

Libertarians take over Argentina, once again

843 words | 5 minutes reading time

Javier Milei passed the most difficult test of his presidency—and with an overwhelming victory, he has consolidated La Libertad Avanza (LLA) as Argentina’s leading political force.

In perspective. LLA was the clear winner in last Sunday’s legislative elections, dealing yet another blow to Argentina’s traditional political class—la casta—and giving Milei’s project a fresh mandate of public confidence. Preliminary results place the libertarians at 40.65% of the vote, followed by Fuerza Patria (and provincial allies) with only 31.70%.

The rest of the vote was distributed among Provincias Unidas (7%), Socialists (4.76%), and 15% for provincial or smaller parties, which together secured eight seats.

If the results are ratified, LLA will have obtained 64 of the 127 Chamber of Deputies seats in dispute (50% of those up for renewal) and 13 of the 24 Senate seats contested in this cycle.

Fuerza Patria, which was defending 46 lower-house seats, will emerge with 44—losing two positions in Congress.

Why it matters. LLA, in alliance with the center-right PRO, has expanded its lower-house presence from 37 to 93 deputies. Together with the 14 legislators the PRO still holds from the previous term, Milei’s bloc will now command 107 of 257 deputies, or roughly 41% of the Chamber—enough to overcome opposition vetoes that paralyzed many of his reforms during his first two years in office.

More importantly, Milei will no longer need to negotiate directly with the Peronists, as there will now be 54 swing or provincial deputies available for ad hoc coalitions. These legislators will act as crucial intermediaries in securing legislative majorities.

This larger parliamentary base grants Milei the political weight he lacked early in his presidency, despite holding the Executive Branch.

Yet his stability will still depend on the provincial interests of these dispersed lawmakers: to pass key bills, he will need to secure the backing of at least 22 of the 54 swing deputies.

Seen and unseen. Unlike in previous elections, Argentina implemented a Single Paper Ballot (Boleta Única de Papel, or BUP) for these legislative contests. Previously, the country relied on multiple partisan ballots, each printed and distributed by the political parties themselves.

That old system favored parties with extensive territorial machinery—especially the Peronists and Radicals—who controlled local ballot distribution through networks in schools, municipalities, and rural districts.

This gave large parties a decisive logistical advantage: they could deploy electoral monitors and replenish ballots throughout election day. For new or minor forces like LLA, lacking such structure, that system was a significant handicap.

The introduction of the BUP leveled the playing field. It allowed LLA to compete effectively in constituencies with a strong Peronist presence, even without the dense party infrastructure that left-wing movements maintain through provincial governorships.

The key. The most striking result came from Buenos Aires Province (PBA), the country’s largest electoral district. Polls from CB Consultora had predicted a close race, estimating around 40% for LLA and 35% for Fuerza Patria—a projection that proved accurate in direction but underestimated the margin. In reality, Milei pulled off an upset in PBA, winning by roughly one percentage point and overturning a 14-point deficit left just a month earlier by Peronist governor Axel Kicillof, who had defeated LLA in the provincial elections by up to 13%.

The turnaround was largely due to Patricia Bullrich’s strong performance in Buenos Aires City, which energized the broader right-wing coalition and strengthened LLA’s vote share in the province.

Buenos Aires Province alone accounts for 38% of Argentina’s total electorate, making it the pivotal battleground of any national contest.

Combined with Milei’s victories in Mendoza, Santa Fe, and Córdoba—the country’s next three most populous provinces—the PBA result sealed the right’s sweeping national triumph.

The bottom line. Kicillof’s failure to replicate his provincial success at the national level has now placed his leadership under scrutiny. It was the governor himself who pushed to decouple provincial elections from the national vote in an attempt to weaken Milei—a move that ultimately backfired.

With his strongest leader politically weakened, Argentina’s left faces an unprecedented leadership crisis.

The Peronist movement, long the dominant political machine of Argentine democracy, now finds itself fragmented and directionless.

For Milei, the road ahead looks significantly smoother than expected—though not without obstacles.

What’s next. With LLA now consolidated as Argentina’s first political force, Milei finally gains the governability he lacked during his turbulent first half of the term. However, he still lacks the self-sufficiency needed to govern without negotiation. The electorate’s fatigue with la casta granted him enough credit to survive early turbulence, but the results of the elections mark the end of that grace period.

The president will now face growing pressure to deliver tangible results—particularly on inflation, fiscal reform, and security—as public patience wears thin.

The libertarian right has become the gravitational center of Argentine politics, while the left struggles to redefine itself amid corruption trials, institutional exhaustion, and public disillusionment.

Milei’s project—radical, anti-establishment, and increasingly pragmatic—has survived its first major stress test. The coming months will determine whether it can evolve from an insurgent movement into a durable governing force capable of reshaping Argentina’s long-fractured state.

China’s economic trajectory has entered a decisive slowdown—one that appears structural rather than cyclical.

In perspective. After more than a decade of deceleration, quarterly real GDP growth has stabilized below 5%, a far cry from the double-digit expansion that defined its rise in the 2000s. The graph illustrates a long decline interrupted only by short-lived rebounds, notably the pandemic’s artificial spike and post-lockdown normalization. Beneath that curve lies a deeper truth: the Chinese miracle has matured, and the ceiling has become visible.

China’s peak years of expansion were driven by industrial overcapacity, state-driven investment, and demographic abundance. Each of those engines are now stalling.

The working-age population is shrinking, debt-fueled construction no longer drives growth, and export dependence faces limits amid global fragmentation and U.S.-led reshoring.

Beijing’s attempts to transition toward domestic consumption and advanced manufacturing have met structural inertia. Consumption remains weak, local governments are overleveraged, and private firms face political uncertainty.

Between the lines. The slowdown is not merely economic, but geopolitical. China’s leadership appears to have accepted slower growth as the price of greater state control. Xi Jinping’s consolidation of political power and reorientation toward “national security economics” mark a strategic trade-off: stability and ideological coherence over the risks of liberalization.

The result is a China less dynamic but more predictable internally, prioritizing resilience and self-sufficiency over unbounded growth.

Why it matters. For Washington, the implications are profound. China’s inability—or unwillingness—to surpass the U.S. in aggregate economic size delays what once seemed inevitable: a transfer of global primacy. The U.S. remains dominant in nominal GDP, innovation, financial power, and, most importantly, military power, while Beijing’s relative deceleration suggests a plateau in its global leverage.

The “hegemonic race” has thus transformed from a sprint into a long, defensive standoff—where influence depends less on growth and more on technological leadership, alliances, and control over critical supply chains.

Bottom line. The era of China’s hypergrowth is over. The Communist Party may have intentionally capped the country’s economic ascent to preserve political control, but in doing so, it has conceded the momentum that once threatened to upend U.S. hegemony.

The balance of power is now less about catching up and more about entrenching influence—China through discipline and regional dominance; the U.S. through innovation, markets, and alliance networks.

The giant has not fallen, but he may have stopped climbing.

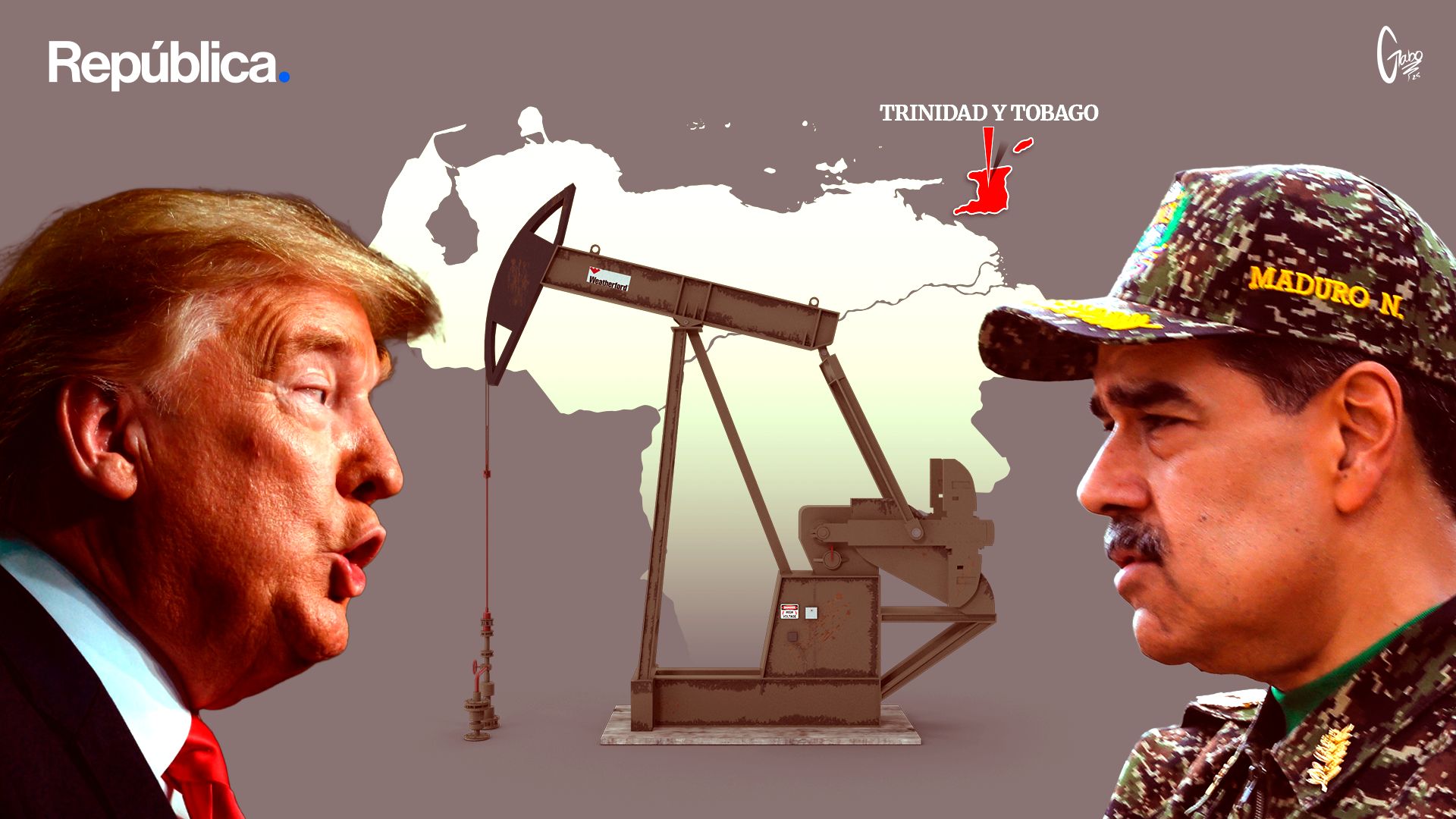

Trump in search of the oil faucet in the Caribbean

495 words | 2 minutes reading time

The U.S. destroyer USS Gravely docked in Port of Spain at the end of October, unleashing a diplomatic storm between the United States, Trinidad and Tobago, and Venezuela.

In perspective. Venezuelan Vice President Delcy Rodríguez announced the suspension of energy agreements with Trinidad, denouncing what she called a “hostile maneuver” that threatens Venezuelan sovereignty. The dispute centers on the Dragón gas field, a key Caribbean asset and a symbol of the struggle between regional security and control of strategic resources. The controversy unfolds at the intersection of security and energy in the Caribbean, where U.S. licenses and Trinidad and Tobago’s gas needs reactivated a project previously constrained by sanctions.

In January 2023, the United States granted a specific license to Trinidad and Tobago to advance development in the Dragón field, authorizing limited activity under strict conditions.

By late 2023 and early 2024, Washington withdrew the permit and reinstated OFAC’s financial restrictions, allowing only a short transition period for existing contracts to close.

On October 9, 2025, Washington issued a new license for Shell and the Trinidadian government to resume negotiations, under the condition that profits to the Maduro government remain limited.

How it works. The current scheme combines financial sanctions, conditional licenses, and logistical oversight to subordinate Venezuelan production to Washington’s strategic energy calculus—keeping regional supply stable without granting the Maduro regime significant liquidity.

Royalties and dividends are once again paid in barrels of crude or gas, forcing PDVSA to market them independently, often at heavy discounts.

Because Venezuelan crude remains sanctioned, Caracas must resort to complex triangulations through third parties, eroding profit margins and increasing costs.

With Rosneft and Lukoil under sanctions, PDVSA has lost its main alternative channels, deepening its isolation from international finance and increasing dependence on U.S.-regulated licenses.

Between the lines. The United States is effectively engaging in “friend-shoring” with Trinidad and Tobago—aligning regional energy security, OFAC compliance, and diplomatic leverage to project geoeconomic influence through reliable partners.

The recent suspension of cooperation between Caracas and Port of Spain exposes Washington’s broader effort to reconstitute the pre-Petrocaribe energy sphere and weaken Maduro’s residual reach in the Caribbean.

By cultivating a network of compliant energy partners, Washington aims to replace the Venezuelan model of subsidized diplomacy with one governed by Western financial norms, limiting exposure to non-aligned powers—notably China and Russia—in the regional energy landscape.

In conclusion. The Dragón dispute is more than a bilateral quarrel; it reflects the restructuring of the Caribbean’s energy order under U.S. strategic oversight. For Washington, regaining control over the region’s gas flows serves both economic and geopolitical ends: containing Venezuelan influence, countering extra-hemispheric actors, and securing a stable, sanctions-compliant energy corridor.

For Maduro, the crisis underscores Venezuela’s shrinking leverage—even within its own maritime frontier—and the cost of a decade-long strategy that traded sovereignty for survival.

The Caribbean’s new energy map will likely be drawn not by ideology but by the logistics of compliance—and by who controls the pipelines, ports, and permissions that keep the gas flowing.

What We’re Watching 🔎 . . .

Nobel Peace Prize Winner: US Escalation Is ‘Only Way’ to Free Venezuela [link]

Mishal Husain, Bloomberg

Venezuelan opposition leader María Corina Machado, newly awarded the Nobel Peace Prize, says U.S. military pressure is the “only way” to force Nicolás Maduro from power. Speaking from hiding after 15 months under threat of arrest, Machado argued Venezuela has become a hub for narco-terror networks (cartels, Iranian and Russian agents, Hezbollah/Hamas) and that a “credible” use-of-force threat is needed to trigger an orderly transition.

Her remarks land as Washington authorizes covert CIA operations, deploys a carrier strike group to the Caribbean, and expands maritime strikes on alleged drug boats—moves critics call extrajudicial; supporters frame as war-lawful action against nonstate armed groups. Machado’s line closely tracks the Trump administration’s framing of an “armed conflict” with cartels and its view that Maduro is an illegitimate ruler heading the Cartel de los Soles. Machado’s Nobel amplifies an opposition figure who pairs democratic legitimacy with endorsement of hard-power coercion.

U.S. poised to strike military targets in Venezuela in escalation against Maduro regime [link]

Antonio María Delgado, Miami Herald

The Miami Herald reports that the Trump administration is preparing to strike military installations inside Venezuela, escalating its campaign against Maduro. Sources said airstrikes could occur “within days or hours,” targeting facilities tied to drug trafficking and aiming to “decapitate” the cartel’s leadership.

Washington has doubled its reward for Nicolás Maduro to USD 50 million, with similar bounties on senior figures like Diosdado Cabello and Vladimir Padrino López, both accused of running cartel operations. The U.S. military buildup in the Caribbean now includes the USS Gerald R. Ford carrier group, F-35B fighters, and Reaper drones, already used in maritime raids that have killed at least 61 suspected traffickers.

White House and State Department officials denied reports of imminent action, calling them “inaccurate.” Still, analysts see the deployments as part of a “final phase” designed to pressure regime insiders and force a leadership collapse without a ground invasion.