- GCaM

- Posts

- Milei’s Judgment Day

Milei’s Judgment Day

Dear all,

We welcome you to the Greater Caribbean Monitor (GCaM).

In this issue, you will find:

Judgment Day for Milei: a turning point or a breaking point

The Petro-Trump wrestle: escalating geopolitics

What We’re Watching

As always, please feel free to share GCaM with your friends and colleagues.

If you’ve been forwarded this newsletter, you may click here to subscribe.

Best,

The GCaM Team

Judgment Day for Milei: a turning point or a breaking point

1167 words | 5 minutes reading time

Javier Milei faces his greatest challenge so far, with the opportunity of flipping the switch on his governability or risking a permanent gridlock on the rest of his presidency. This Sunday’s elections will be a turning point for his libertarian project, and the race couldn’t be any tighter.

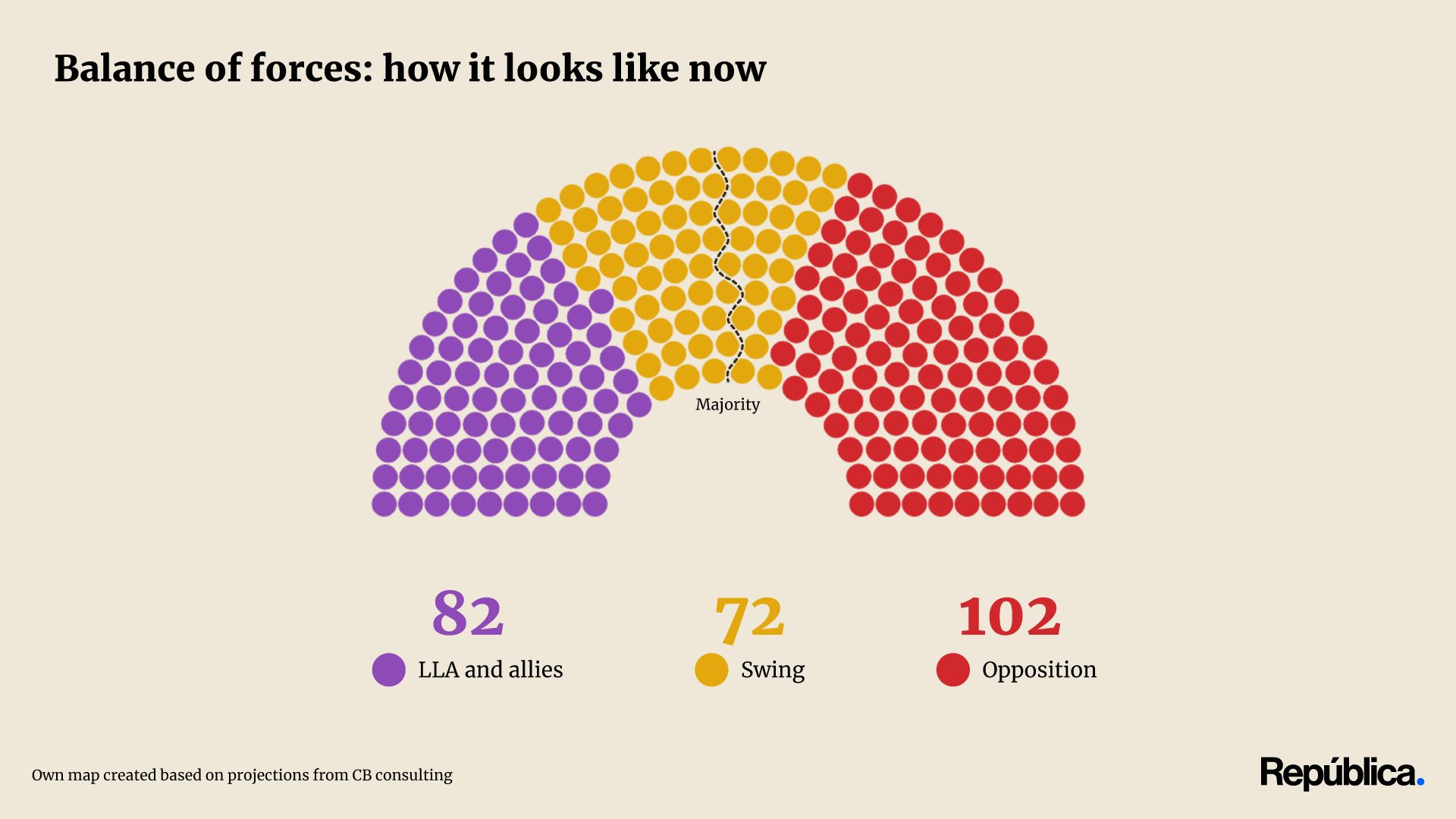

In perspective. Argentina’s Chamber of Deputies currently reflects the fragmented and fluid nature of the country’s political landscape. Out of the 257 seats, La Libertad Avanza (LLA) and its allies hold around 82, give or take; the opposition—led by Unión por la Patria and the remnants of Juntos por el Cambio—commands 102, and a decisive 72 seats fall into the “swing” category, which consists of regional blocs, provincial parties, and independents that act as power brokers.

This fragmentation has defined President Javier Milei’s first year in office, forcing him to rely on tactical alliances and short-lived pacts rather than a cohesive majority.

In practice, this has transformed every major legislative initiative—from fiscal reforms to privatizations—into a test of endurance and negotiation.

The government’s success often depends on temporary deals with centrist factions, particularly from provincial Peronist and Radical benches.

How it works. What we call the swing bloc has emerged as Milei’s lifeline but also as his greatest constraint. Their transactional nature grants them leverage to extract local concessions, diluting the administration’s ideological purity. Meanwhile, the hard opposition has consolidated around former Kirchnerist and left-wing fronts, which have rejected Milei’s austerity agenda and questioned his foreign policy alignment with the U.S. and Israel.

The current Congress mirrors Argentina’s political paradox: a president with undeniable popular backing but a legislature structurally designed for deadlock, where no faction can govern—or block—without coalition-building.

It’s a delicate balance that has kept Milei’s libertarian project alive but barely moving forward.

The president’s popularity has held impressively strong considering how tough the effects of the former administration—as well as his fiscal reform—have been on the country, but while his approval is enough for survival, it might not be enough for tomorrow’s elections.

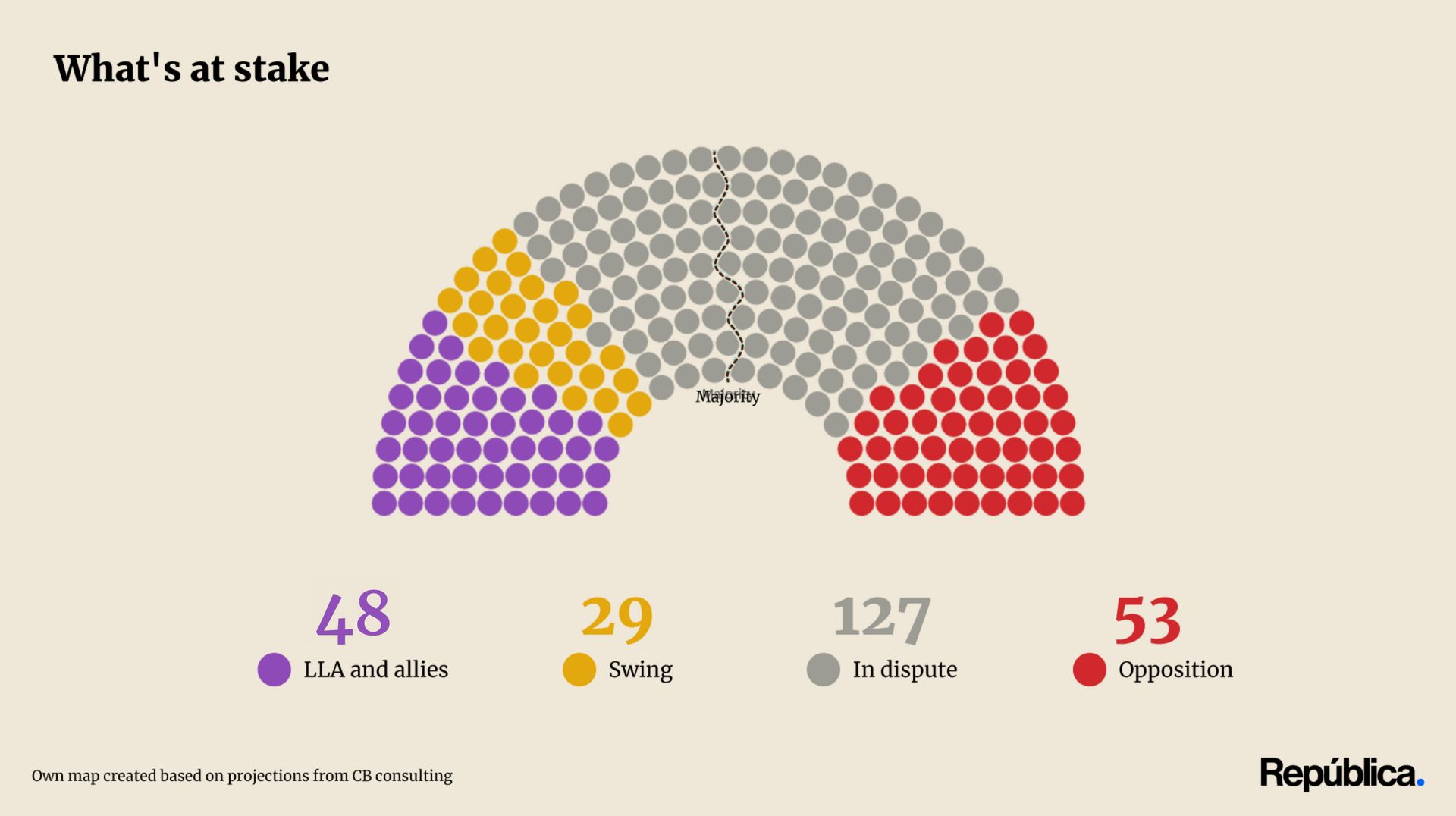

Between the lines. As Argentina heads to the polls, around half of the lower chamber—127 out of 257 seats—will be renewed. The stakes could not be higher for President Javier Milei, whose legislative ambitions depend on expanding LLA beyond its current minority.

The math is clear: the opposition controls a larger share of the seats up for re-election, meaning that even a modest swing toward LLA could tilt the composition of Congress in Milei’s favor.

Out of the 127 seats at stake, 49 belong to opposition parties, while LLA only defends 34 total, allowing it more room to gain than to lose.

Numbers are even better if you consider only the two main parties in the incumbent and opposition blocs (LLA and UxP—now Fuerza Patria), with only 8 of the libertarians up for reelection, in contrast with the 46 peronists at stake.

The tipping point. Since its emergence as an outsider movement in 2021, LLA has grown from a disruptive faction into a governing force, absorbing disillusioned conservatives and libertarian-leaning Radicals while drawing parts of the middle class frustrated with Peronism’s decline. Yet, its parliamentary weakness remains Milei’s Achilles heel. Without at least one-third of the chamber (roughly 86 seats), he cannot avoid legislative vetoes or push through key reforms that require special majorities.

The election is not just about numbers—it’s about survival. For Milei, this is a referendum on his shock-therapy economics and anti-caste crusade against Argentina’s political establishment. And so far, patience for his aguante request seems to start running shorter.

For the opposition, it’s a fight to contain a president who has redefined political discourse around fiscal discipline and state retrenchment.

Behind the arithmetic lies the broader test of governability: whether Argentina can transition from a fragmented Congress to a functional one—or whether Milei will continue governing through decrees, confrontation, and improvisation.

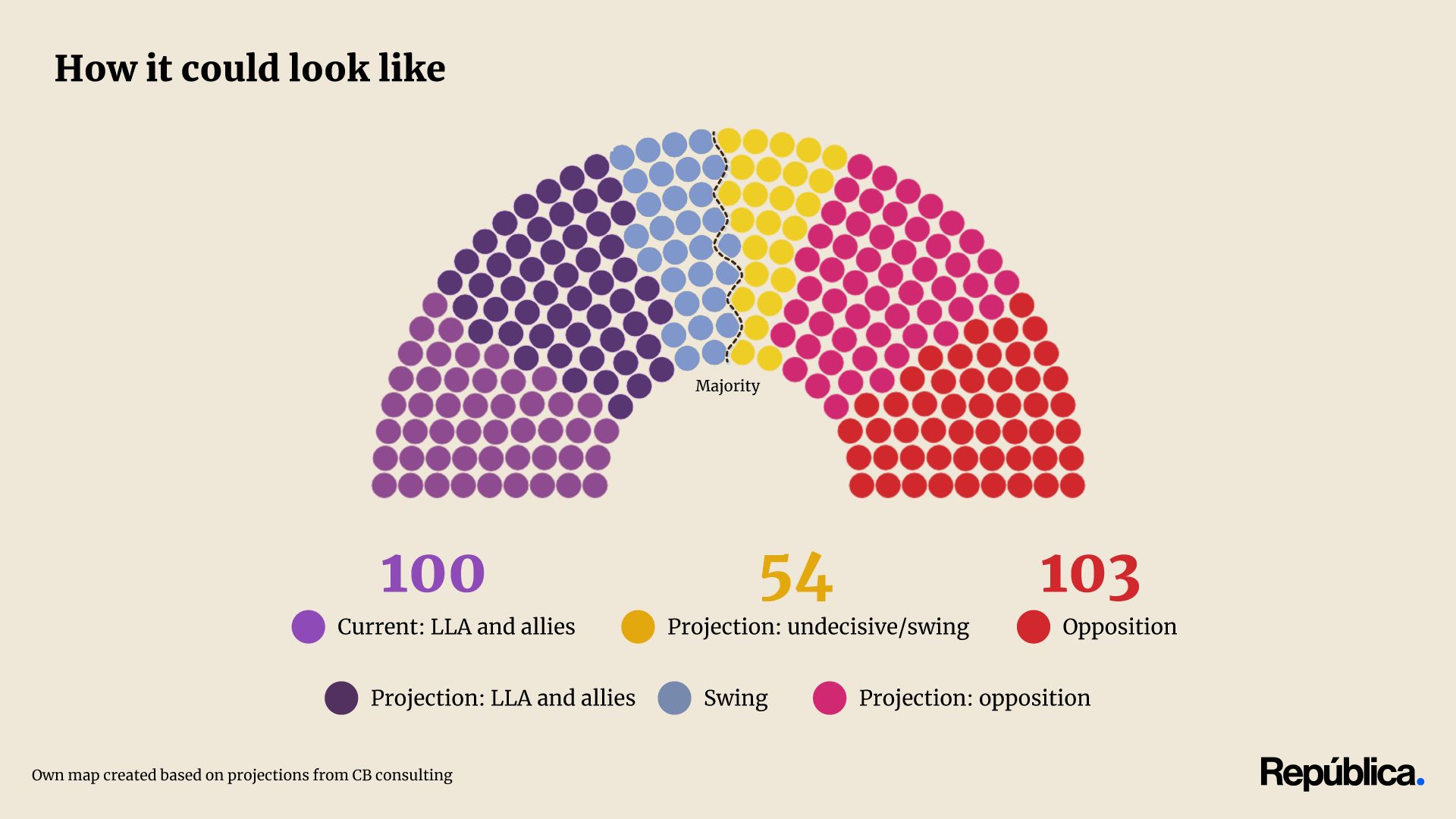

The data. If the latest projections hold, LLA will emerge as the clear winner of Sunday’s elections—but still far from an outright majority. CB Consultora, the first polling firm to accurately predict Milei’s 2023 victory, now forecasts a 40.8% lead for LLA, followed by Fuerza Patria + PJ Provinciales with 35.4%.

Provincias Unidas, an emerging centrist third force, is polling at around 7%, while the Socialists are projected to secure approximately 4.4%. The remaining 12.3% of voters remain split among minor parties and undecided voters.

If national polling translates proportionally to Congress seats, estimates would place LLA and its allies at around 100 seats, a notable rise from their current 82.

The opposition—a mix of Peronists, Kirchnerists, and remnants of the old center-right coalition—would retain about 103, while roughly 54 seats remain in the hands of swing or undecided blocs that will determine legislative viability.

Yes, but. National polling can be tricky. Districts like Buenos Aires Province (PBA) —the most populous in the country—are largely overrepresented. Milei leads nationwide; however, he is trailing the left in PBA, where LLA already lost local elections last September. In the last midterms, back in 2021, the popular vote results closely mirrored the actual seat distribution. While Juntos por el Cambio (JxC) won 42.75% of the vote, it secured 61 of the 127 seats in dispute (48.03%). Frente de Todos (FdT), on the other hand, obtained 34.56%, translating into 50 seats (39.37%).

The opposition performed above polling predictions, winning PBA by a 1% margin and also taking Córdoba, Santa Fe, and Mendoza—the country’s four most populous provinces.

For these elections, LLA trails Fuerza Patria by nearly nine points in PBA, while Córdoba and Santa Fe are expected to be extremely close races, with the president running strong only in Mendoza.

The race remains too close to call, but Milei’s numbers are not nearly as favorable as those of the right in 2021. While national polling once proved effective for predicting seat distribution, the magnitude—and unpredictability—of at least two of the four key districts makes it much harder to rely on this time.

In conclusion. This possible outcome would strengthen Milei’s position but not his autonomy. With no path to a majority, his government would continue to rely on issue-by-issue alliances, particularly with centrist governors and provincial parties. The map suggests a Congress where no side dominates—an image of institutional equilibrium, but also of political inertia. In practice, it would leave Argentina governed through negotiation, executive decrees, and public pressure rather than cohesive policymaking.

Still, the results would mark a symbolic victory for Milei’s libertarian experiment. Expanding to triple-digit representation would cement LLA as Argentina’s second major political force, displacing traditional coalitions and institutionalizing the libertarian right as a permanent player.

For investors and foreign partners, that shift signals a degree of continuity in Milei’s market-oriented agenda—even if legislative execution remains slow.

But the limits of arithmetic remain decisive. With fewer than 130 seats, Milei will face structural gridlock on deeper reforms that require congressional consensus. The next two years, therefore, will test whether Milei can convert popularity into governability, or whether his revolution will remain a loud—but stalled—experiment inside Argentina’s divided democracy.

A MESSAGE FROM GRUPO AG

Grupo AG: the ally that drives projects and supports Guatemala’s future

Steel is more than just a building material—it’s the backbone of projects, communities, and dreams that are transforming the nation. Every rebar, every structure, reflects decades of innovation, expertise, and unwavering commitment.

Why it matters. In Guatemala, Hierro AG stands as Grupo AG’s flagship product. Its unmatched quality has empowered thousands of Guatemalans to build homes, grow businesses, and create robust infrastructure that fuels the country’s development.

Today, the nation’s iconic projects symbolize competitiveness, progress, and ambition. When you think of Hierro AG, you think of trust—a legacy that supports the present and shapes the future for generations to come.

Looking ahead. Steel doesn’t just build—it drives and sustains the dreams that define Guatemala.

Explore this launch [here].

The Petro-Trump wrestle: escalating geopolitics

482 words | 2 minutes reading time

The latest clash between Donald Trump and Gustavo Petro has escalated from rhetoric into a full-blown geopolitical confrontation. What began as a dispute over military operations and human rights has evolved into a contest of influence amid Latin America’s shifting political balance. The U.S. is once again forcing its way into the region’s internal affairs—and Petro’s Colombia has become the latest flashpoint.

In perspective. Over the past month, Petro–Trump tensions have jumped from speeches to punitive actions, intertwining diplomacy with tariffs, security, and foreign aid.

At the U.N. General Assembly in late September, Petro called for a criminal investigation into Trump over lethal U.S. strikes on boats in the Caribbean.

Shortly after, Washington retaliated by revoking Petro’s U.S. visa, citing “incendiary” interference in domestic affairs following his remarks encouraging American soldiers to disobey orders. Trump responded by labeling Petro an “illegal drug leader,” announcing new tariffs, and ending U.S. aid to Colombia.

The U.S. Treasury sanctioned Petro, his wife, his son, and Colombia’s interior minister—freezing any U.S. assets, prohibiting trade with American citizens, and restricting entities under their ownership.

Why it matters. U.S. assistance has long served as a stabilizing tool for political relief and its withdrawal could destabilize Colombia’s equilibrium.

While USAID, before its dismantling, had already frozen roughly USD 70 million in environmental funds earlier this year, the more consequential cuts target military programs tied to internal security and counternarcotics operations—including helicopters, intelligence, and logistics.

Petro acknowledged that reduced cooperation would weaken operational capacity, even as he downplayed its overall economic impact.

The aid brinkmanship injects uncertainty into Colombia’s fiscal and security outlook just months before elections, raising its political risk premium, undermining investor confidence, and potentially shaping voter behavior in the short term.

Between the lines. Beyond Colombia, the confrontation fits Washington’s broader strategy to reshape Latin America’s alignments amid a fragmented global order. Trump’s use of economic coercion seeks to pressure Bogotá into political realignment—weakening Petro’s legitimacy and steering Colombia’s electorate toward a pro-market, right-leaning alternative ahead of next year’s elections.

Regaining influence over Colombia would give Washington direct leverage over counternarcotics routes, cutting off drug-financing pipelines that sustain regional insurgencies.

The move serves a dual purpose: reasserting U.S. dominance in the hemisphere and constraining illicit financial networks that act as pressure valves in global conflicts.

By tightening trade and security frameworks across the Andean region, the U.S. aims to limit Brazil’s autonomous leadership within BRICS, consolidating a hemisphere more tightly aligned with U.S. strategic priorities.

In conclusion. Washington is attempting to build a new regional architecture in which security, production, and capital formation orbit around U.S.-led frameworks rather than non-aligned blocs such as BRICS.

A political shift in Colombia would decisively shape how U.S. foreign and security policy is applied across the Andean–Caribbean axis.

A change in leadership would strengthen containment of Brazil’s BRICS-oriented project while intensifying pressure on Venezuela’s illicit logistical and financial networks.

What We’re Watching 🔎 . . .

Ecuador says it has no evidence that survivor of a US strike in the Caribbean committed any crime [link]

Gonzalo Solano, ABC News-Associated Press

Key ally to Trump, President Noboa, has asked for further details of a U.S. strike after an Ecuadorian man who survived on a submersible, accused of transporting drugs in the Caribbean, has been released after prosecutors found no evidence of criminal activity. Another survivor, a Colombian national, remains hospitalized in his country.

The strike—one of at least seven since September—has killed more than 30 people and inflamed tensions across Latin America. President Trump said U.S. intelligence confirmed the vessel was carrying “mostly fentanyl and other illegal drugs,” though little evidence suggests fentanyl production in the Andes.

Colombia has recalled its ambassador to Washington after Trump called President Gustavo Petro “an illegal drug leader” and “a lunatic,” while Ecuador’s Daniel Noboa reaffirmed support for the U.S. “war on cartels”, but showing possible reasons for future fractures. Trump insists the U.S. is in an “armed conflict” with drug networks—invoking post-9/11 legal reasoning—a stance reshaping hemispheric diplomacy.

Cuba arrests alleged Chinese fentanyl kingpin who escaped custody in Mexico [link]

The Guardian-AFP

Cuban authorities have arrested Zhi Dong Zhang—known as “Brother Wang”—a Chinese national accused of laundering money for the Sinaloa and Jalisco New Generation cartels, according to Mexican security sources. Zhang escaped house arrest in Mexico in July while awaiting extradition to the U.S., where he faces money laundering charges.

Mexican officials describe Zhang as a “major international operator” linking Chinese suppliers to Latin American cartels in the global fentanyl trade. He is expected to remain in Cuban custody pending an extradition decision.

Washington has intensified pressure on both Mexico and China to curb fentanyl trafficking—the synthetic opioid behind the U.S. overdose crisis. Zhang’s arrest marks the first major intersection of Beijing, Havana, and Washington in the hemispheric drug war, as the U.S. expands its enforcement lens from Mexican cartels to their Chinese chemical partners.