- GCaM

- Posts

- A Chaotic Realm for Dragons and Libertarians

A Chaotic Realm for Dragons and Libertarians

Dear all,

We welcome you to the Greater Caribbean Monitor (GCaM).

In this issue, you will find:

Is Central America the Stage for China?

The Defining Test for Milei’s Political Revolution

As always, please feel free to share GCaM with your friends and colleagues.

If you’ve been forwarded this newsletter, you may click here to subscribe.

Best,

The GCaM Team

Is Central America the Stage for China?

569 words | 3 minutes reading time

A shadow has been slowly stretching across Central America—the shadow of China. As economic and political alignments increasingly lean toward Beijing, a quiet geopolitical struggle is unfolding in a region long regarded as a stronghold of U.S. influence.

The Trump administration’s recent—and arguably ineffective—maneuver in Panama through BlackRock underscores a rising concern within U.S. foreign policy circles: the expanding influence of China in Central America.

While the U.S. leans on security partnerships, such as those in El Salvador, China is building its foothold through trade, offering access to its vast consumer markets with few political strings attached.

This is no longer a loud, ideological contest—it is a strategic, asymmetric game, and it’s unfolding right on America’s doorstep.

Why It Matters. Central America has been quietly pivoting toward China for nearly two decades. One by one, countries in the region have dropped recognition of Taiwan in favor of Beijing — even those led by governments that don’t share China’s political ideology.

Trade with the Asian giant has surged, offering real economic gains, while Chinese development banks provide loans with far fewer strings attached than their Western counterparts.

Together, these incentives—market access and easy credit—are starting to raise questions: Could China’s growing influence shape the region’s domestic policies or regulations?

Overview. Engaging with China carries inherent risks—but only under specific domestic conditions that amplify dependency and weaken a country’s bargaining power.

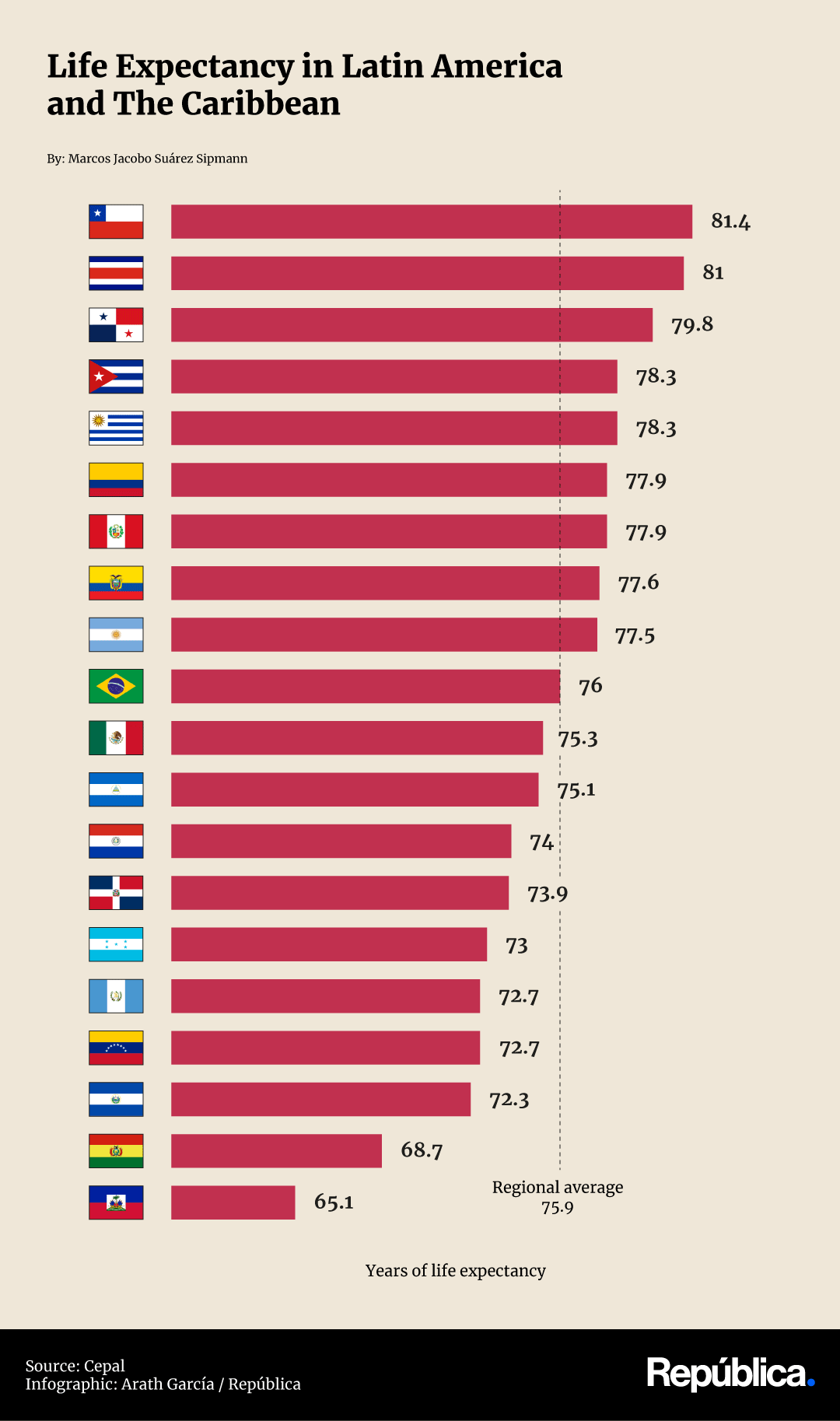

High trade volumes with China do not necessarily equate to political alignment. Countries like Chile, Peru, and Panama maintain robust commercial ties with Beijing without significantly shifting their foreign or domestic policy in its favor.

The real risk emerges in regions where financial alternatives are scarce. In these contexts, China can use its economic leverage to apply pressure, effectively nudging states toward alignment by default.

Such dependency is often self-inflicted: cases like Argentina under Fernández or various Caribbean nations illustrate how mounting debt and weak governance have led governments to turn to Beijing, not out of ideological affinity, but as a last resort.

Bottom Line. For now, China does not pose an immediate threat to Central America. One possible avenue for growing influence might have opened with USAID’s retreat from the region, but Beijing has shown little interest in stepping into that vacuum.

Unlike Washington, which traditionally channels aid into social and development projects, China has focused its investments on technology, energy, and artificial intelligence.

Central America's limited purchasing power further curtails its appeal; Beijing tends to prioritize markets with higher consumption potential.

Historically, populist governments in the region have leaned on large infrastructure projects to attract foreign backing. But even that model appears to be fading, as Chinese banks shift their focus away from traditional infrastructure and toward sectors tied to innovation.

In Conclusion. Trump’s stance on Chinese influence in Central America appears rooted more in ideological posturing than in a nuanced reading of regional realities.

While geopolitical hedging remains a legitimate strategic concern, current evidence points to a Chinese presence that is expanding but not yet coercive or destabilizing.

Central America lacks the structural conditions for deep dependency: its market potential is limited, the era of infrastructure diplomacy is waning, and its foreign relations remain relatively diversified. In this context, the shadow of China functions more as a political talking point than an imminent threat.

The real question is whether the U.S. will calibrate its response with proportionality in the coming years.

The Defining Test for Milei’s Political Revolution

430 words | 2 minutes reading time

With 173 days until Argentina’s legislative elections, President Javier Milei faces a critical juncture after 18 months in office.

In Perspective. The elections will renew 127 of the 257 seats in Congress and 24 of the 72 in the Senate, potentially strengthening or undermining the control of Milei’s La Libertad Avanza (LLA) in the legislature.

This year marks the national debut of the Single Paper Ballot (BUP), while the PASO primaries have been suspended, disrupting traditional party strategies.

With the economy in recession but inflation slowing, Milei confronts a pivotal challenge. His ability to translate his disruptive rhetoric into legislative majorities will gauge the success of his tenure thus far.

How It Works. The BUP lists all candidates on a single national ballot, replacing individual party ballots. This could reduce patronage-based voting, favoring Milei with independent voters who support him, but may disadvantage LLA in districts where its organizational structure is weak, as the opposition gains equal visibility.

Current polls show LLA leading with 36.9% of voter intention, followed by Kirchnerism at 25.9%, non-Kirchnerist Peronism at 10.1%, PRO at 9.1%, and UCR at 4.1%.

Milei’s approval rating hovers around 47%, weathering social tensions caused by his austerity measures.

A victory would grant Milei greater autonomy to advance his agenda and cultural battle, while a defeat would force him to negotiate with a fragmented but resilient opposition.

Between the Lines. Staggered elections, like those held for the Autonomous authorities of the City of Buenos Aires on May 18, provide a gauge of public sentiment ahead of the national vote on October 26.

Strong local performances could boost LLA if Milei’s appeal carries over, but growing urban discontent could favor the opposition.

Argentina’s electoral system allocates a minimum number of seats per province, overrepresenting smaller, traditionally Peronist districts. The elimination of PASO forces parties to resolve internal disputes, potentially concealing cracks within LLA or amplifying them if cohesion falters.

Navigating Argentina’s complex electoral landscape demands a precise campaign from Milei to avoid losing ground.

Balance. Milei holds an advantage but no guarantees. A strong result—exceeding 40% of the vote and nearing 129 seats—would reduce LLA’s reliance on allies like PRO or UCR, whose differences with Milei’s vision fragment LLA’s political capital.

To succeed, Milei must keep inflation in check, reinforce perceptions of public safety, and avoid missteps like controversies over his cryptocurrency or crackdowns on pensioners. However, rising unemployment, public fatigue with austerity, and a potential united opposition pose significant risks.

A tight race is expected, with Milei facing a significant challenge to prove his revolution can solidify into a lasting structure.

What We’re Watching 🔎 . . .

Brazil’s Lula Pitches ‘Strategic Partnership’ With Russia [link]

The Moscow Times

On the first visit to Moscow by a Brazilian president in 15 years, Luiz Inácio Lula da Silva criticized Donald Trump’s tariff policies, calling them a threat to free trade and multilateralism.

In a meeting with Vladimir Putin, Lula proposed a “strategic partnership” encompassing cooperation in key sectors such as nuclear energy, defense, science, technology, and space—highlighting Brazil’s interest in developing small nuclear reactors. The encounter took place during commemorations of the 80th anniversary of the Soviet victory in World War II, which was also attended by leaders including Xi Jinping.

The meeting reaffirmed the alliance between Brazil and Russia, both founding members of BRICS. Lula emphasized the potential to deepen trade ties based on shared interests, while Putin underscored Brazil’s importance as a food supplier and its reliance on Russian exports of oil and fertilizers.

Mexico's Pemex aims to reopen wells to boost falling oil output, documents and sources say [link]

Stefanie Eschenbacher, Adriana Barrera & Ana Isabel Martinez, Reuters

Pemex, Mexico’s state-owned oil company, is facing a sustained 11% decline in oil production, currently averaging around 1.6 million barrels per day—well below its 1.8 million target—while remaining one of the most indebted oil firms globally.

In an effort to offset the downturn, Pemex plans to reactivate over 4,800 shuttered wells, both onshore and offshore. However, the company faces significant budget constraints and technical hurdles, including low reservoir pressure and water intrusion, which require costly and specialized technology. The lack of investment in new reserves and the accelerated depletion of key fields raise the risk that Mexico may need to import crude to supply its refineries.

Despite these challenges, Pemex increased its oil exports to Cuba by nearly 20% in 2024, reaching 20,100 barrels of crude and 2,700 barrels of refined products per day—worth an estimated USD 600 million. Although initially considered donations, the shipments were recorded as sales amid Cuba’s severe energy crisis and U.S. sanctions, representing 2.8% of Pemex’s total crude exports.